All-New Dining Options On Norwegian Aqua Revealed!

19 Apr, 2024 | Cruise Lines, Latest News, News, Norwegian Cruise Line, Uncategorised

Totally fresh onboard food and drink experiences will debut on brand new Norwegian Aqua, Norwegian...

-

-

New P&O Cruises Summer 2026 Sailings Revealed!

16 Apr, 2024 | Cruise Lines, Latest News, News, P&O

Our Ultimate Guide To Cruising South America

15 Apr, 2024 | Destinations, FEATURES, Tips & Guides, Uncategorised

A South America cruise offers the journey of a lifetime! It’s a continent of heart-pounding...

Our Ultimate Guide To Cruising South America

15 Apr, 2024 | Destinations, FEATURES, Tips & Guides, Uncategorised

A South America cruise offers the journey of a lifetime! It’s a continent of heart-pounding...

-

5 Ways To Keep Kids Entertained On A Cruise

12 Apr, 2024 | FEATURES, Tips & Guides, Uncategorised

-

Complete Guide To Cruise & Stay Holidays

11 Apr, 2024 | FEATURES, Tips & Guides, Uncategorised

-

-

Your Questions on World Cruising, Answered!

2 Apr, 2024 | Feature, Tips & Guides, Uncategorised

Flowers & Frolics: Emerald Dawn In Bloom

18 Apr, 2024 | Cruise Lines, Emerald Cruises, Feature, FEATURES

River cruising experts, Emerald Cruises, are renowned for their stylish array of ships that sail...

-

Your Questions on World Cruising, Answered!

2 Apr, 2024 | Feature, Tips & Guides, Uncategorised

-

Why You Should Cruise at Easter

25 Mar, 2024 | Feature, Tips & Guides

Tips And Tricks For Using The Laundrette On A Cruise Ship

12 Feb, 2024 | FEATURES, Most Popular, Tips & Guides, Uncategorised

When planning a cruise holiday, you’re likely to be excited about the prospect of exploring...

-

-

Six Of The Best Bars On P&O Cruises

22 Jan, 2024 | Cruise Lines, Most Popular, P&O, Tips & Guides

All-New Dining Options On Norwegian Aqua Revealed!

Apr 19, 2024 | Cruise Lines, Latest News, News, Norwegian Cruise Line, Uncategorised

Totally fresh onboard food and drink experiences will debut on brand new Norwegian Aqua, Norwegian...

-

Flowers & Frolics: Emerald Dawn In Bloom

Apr 18, 2024 | Cruise Lines, Emerald Cruises, Feature, FEATURES

-

- Royal Caribbean

- Celebrity

- Princess

- P&O

- Cunard

- MSC

Royal Caribbean Announces New Mexico Beach Club

26 Mar, 2024 | Cruise Lines, Latest News, News, Royal Caribbean, Uncategorised

Royal Caribbean has revealed its brand-new Royal Beach Club Cozumel in Mexico, set to open in...

-

Icon of the Seas Has Finally Arrived!

25 Jan, 2024 | Cruise Lines, Latest News, News, Royal Caribbean, Uncategorised

-

-

-

Celebrity Infinity’s Retreat Undergoes Major Revamp

22 Mar, 2024 | Celebrity, Cruise Lines, Latest News, News

Beloved Celebrity Cruises ship, Celebrity Infinity, has undergone a major transformation of its...

-

-

New Celebrity Ship Makes Grand Debut!

4 Dec, 2023 | Celebrity, Cruise Lines, Latest News, News, Uncategorised

-

-

Hannah Waddingham Announced As Godmother Of Sun Princess

10 Apr, 2024 | Cruise Lines, Latest News, News, Princess, Uncategorised

Princess Cruises has revealed award-winning actress, Hannah Waddingham, as the official Godmother...

-

-

Sun Princess Sets Sail On Maiden Voyage

4 Mar, 2024 | Cruise Lines, Latest News, News, Princess

-

-

New P&O Cruises Summer 2026 Sailings Revealed!

16 Apr, 2024 | Cruise Lines, Latest News, News, P&O

Britain’s beloved cruise line, P&O Cruises, has finally revealed all the details of its summer...

-

Music Star To Perform On Two P&O Cruises Sailings!

19 Mar, 2024 | Cruise Lines, Latest News, News, P&O

-

Six Of The Best Bars On P&O Cruises

22 Jan, 2024 | Cruise Lines, Most Popular, P&O, Tips & Guides

-

-

SpaceX’s Starlink Rolled Out Across P&O Cruises’ Fleet

26 Sep, 2023 | Latest News, News, P&O

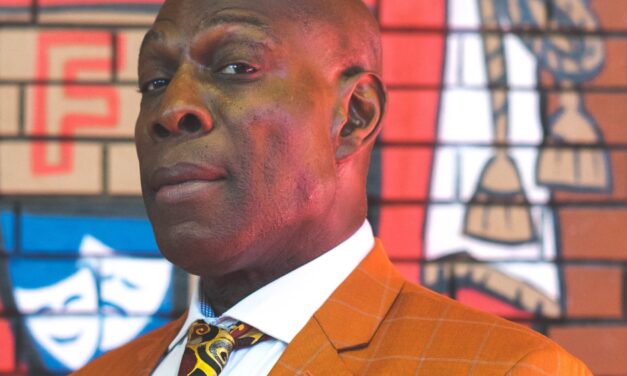

Boxing Legend To Join Queen Anne’s First British Isles Voyage

17 Apr, 2024 | Cruise Lines, Cunard, Latest News, News

Renowned professional heavyweight champion, Frank Bruno, will be joining other stars, and Cunard...

-

West End Show To Debut At Sea On Queen Anne!

3 Apr, 2024 | Cruise Lines, Cunard, Latest News, News, Uncategorised

-

-

Cunard Reveals New 2025/27 Voyages!

20 Feb, 2024 | Cunard, Latest News, News

-

New Cliffhanger Ride To Debut Onboard MSC World America

11 Apr, 2024 | Cruise Lines, Latest News, MSC, News, Uncategorised

MSC Cruises has unveiled that the only over-water swing ride at sea, Cliffhanger, will debut...

-

MSC Cruises Mixes It Up With New Bar Concept

5 Apr, 2024 | Cruise Lines, Latest News, MSC, News, Uncategorised

-

-

MSC Cruises Installs Starlink Fleet-Wide

5 Mar, 2024 | Cruise Lines, Latest News, MSC, News

-

MSC Cruises Launches Fresh Canary Islands Sailings!

22 Feb, 2024 | Cruise Lines, Latest News, MSC, News